Compared to other types of fraud where we envision individuals being the target victims while criminals steal their personal information to perform fraudulent activities, First-Party Fraud is different in that the individual themself is the perpetrator. These individuals are often trying to mislead financial institutions. They may even be working with organized crime rings on a larger scale.

As technology today becomes more advanced, First-Party Fraud tactics are only becoming more sophisticated. So, it can be challenging for institutions to know what to look out for to protect their systems from this type of fraud. However, these advancements in technology are also helping with detection efforts, helping institutions catch and prevent fraud with better speed and accuracy.

What is First Party Fraud?

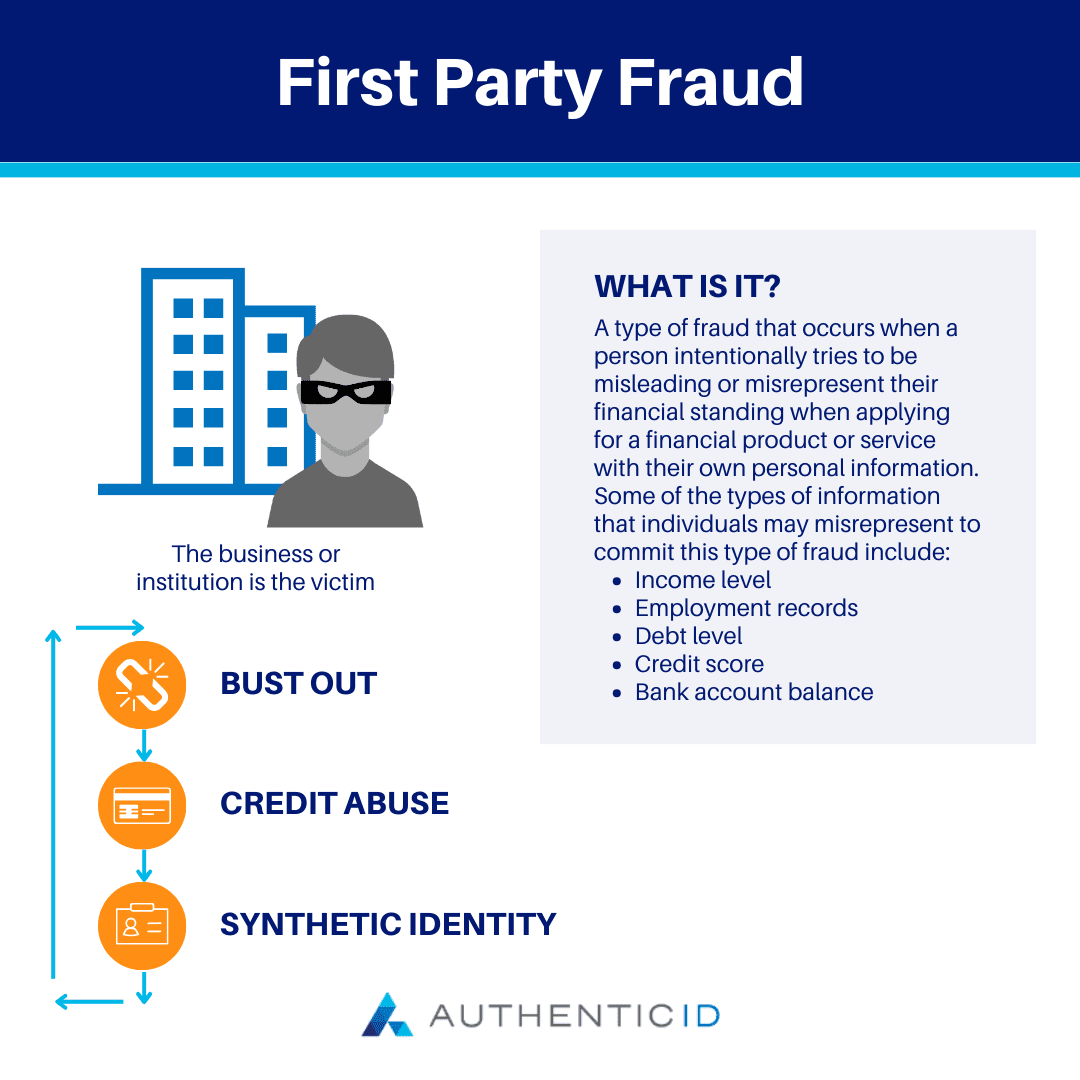

First-Party Fraud (also referred to as first-party identity theft or first-party application fraud), is a type of fraud that occurs when a person intentionally tries to be misleading or misrepresent their financial standing when applying for a financial product or service with their own personal information.

Some of the types of information that individuals may misrepresent to commit this type of fraud include:

- Income level

- Employment records

- Debt level

- Credit score

- Bank account balance

Generally, First-Party Fraud is attempted by a single individual who is trying to deceive an institution for their own gain by submitting a fraudulent application with false personal information. It is an opportunistic crime, looking to take advantage of financial institutions primarily, though it can be present in other industries as well.

How Does First-Party Fraud Work?

Here is a basic layout of how First-Party Fraud works so you can have a better understanding of how to detect when it’s occurring.

First, the fraudster will apply for a financial product or service (credit card, loan, insurance policy, etc.). They will provide false information or manipulate their personal details to increase their chances of approval.

Like we mentioned above, some of the type of data they will often misrepresent includes their income, their employment status, their credit score, and other details as a way to look more favorable to the financial institution.

Upon approval, the fraudster will gain access to the product or service, but under false pretenses. In other words, they likely have no intention of paying off the loan or credit card, or will misuse the policy for their own gain. So, they may make large purchases, take out cash advances, and more without ever planning on paying back their debts.

Eventually, there will be a default or delinquency on their account, and the financial institution will likely write it off as bad debt rather than realizing is was fraudulent from the beginning. Then, the fraudster may move on to another institution to continue the cycle all over again.

Common Types of First-Party Fraud

First-Party Fraud is mostly concentrated in banking and in the financial sector. However, it can extend out to other industries as well. Here are some examples of common uses of First-Party Fraud.

- Loan fraud: Individuals apply for loans with falsified financial information like their income or credit score to up their chances of approval, and have no intentions of paying back the loan after using the proceeds

- Credit card fraud: Fraudsters apply for a credit card with inflated financial data to have better odds of approval, and they do not plan on paying down their account after running it up with transactions

- Insurance fraud: Individuals may exaggerate damages, make up claims, or stage an accident to receive an insurance payout wrongfully

- Retail fraud: Someone will make a legitimate purchase through a storefront, but will claim they were double-charged or that they’re dissatisfied with the purchase to get their money back

Risks of First-Party Fraud

There are a number of risks that First-Party Fraud poses to financial institutions. Here are some of the main problems that can arise with this type of fraud.

1. Misrepresentation as Credit Risk

First-Party Fraud can often appear as credit risk issues as opposed to actual fraud. With third-party fraud, for instance, the individual whose personal information has been stolen for fraudulent activity may notice discrepancies on their credit report, unauthorized use of their credit card, and other instances that may flag that fraud has occurred.

With First-Party Fraud, the person themself is doing the fraudulent activity, so it is up to the financial institution to catch it first. However, it can be extremely difficult to discern the difference between intentional fraud and a person who was financially irresponsible and finds themself unable to pay back their debts.

2. Financial Loss

Financial institutions will take a financial loss when they fall victim to First-Party Fraud. As we mentioned above, this type of fraud will often lead the organization to write off the debt as uncollectable, owing to credit issues with the individual, not intentional fraud.

If the organization is unable to detect or prove that the individual committed fraud rather than become irresponsible with their finances honestly, they will face the financial consequences and be unable to collect the bad debt from the individual.

3. Consequences for Honest Customers

In efforts to detect First-Party Fraud more effectively, institutions may make their services or products more inconvenient for honest customers to access. When more robust fraud detection systems are in place, it can help the organization better protect itself against fraud. However, the extra hoops that good customers have to jump through can become frustrating and detract from the customer experience for genuine customers.

How to Detect First-Party Fraud

Financial institutions and their employees should stay up-to-date on the latest tactics that individuals are using to commit First-Party Fraud. This type of fraud can be costly to organizations, though it’s a complex crime that can be difficult to spot. These are some of the best ways to approach First-Party Fraud detection using a combination of technology, analytics, and manual review.

- Identity Verification: Institutions can use comprehensive identity verification systems throughout the application process to help verify applicants’ identities and spot attempted fraud from the outset

- Document Verification: Organizations should have a document verification process in place to validate the authenticity of documents that are submitted during the application process (IDs, pay stubs, tax returns, etc.)

- Fraud Detection Systems: They should also employ a robust fraud detection system to detect indicators of First-Party Fraud

- Data Analytics: Fraud detection systems should rely on advanced data analytics to identify patterns and anomalies in applications that may point to fraudulent activity

- Historical Behavior Analysis: Institutions’ systems should monitor and track historical behavior to watch out for potential changes in account usage that might suggest fraud; monitor any signs of unusual activity to identify irregularities in spending patterns