Financial Services Identity Verification

Secure Identity Verification for Financial Service Transactions

The ultimate solution for maximized account openings, fraud detection, and better customer experiences.

Fraud Across Financial Services

Your identity verification process faces significant threats. At nearly any point in the customer journey, there are new risks to data privacy, fraud protection, and security. Bad actors and fraudsters are continuously finding new ways to infiltrate your security measures and protocols.

Impact numbers are courtesy of Transunion, AFCE, and Sift.

Financial Fraud Solutions

Advance your organization with our range of identity services for in-branch banking, self-service kiosks, call centers, online, or mobile app transactions.Streamlined Application & Account

- Onboarding

- Fraud Detection & Deterrence

- Login Protection with Ongoing Biometric Authentication

- KBA & Database Lookup Replacement

- KYC & AML Compliance

Stop Fraud While Increasing Account Openings with Frictionless Sign-Up

Discover how our 100% automated machine learning identity verification process can help you achieve your enterprise objectives while removing risk from synthetic identity fraud.

Alleviate friction for a seamless onboard workflow.

Simplify customer onboarding with 100% automated, instant ID document verification and biometric verification, leading to more account openings.

Leverage Biometric Authentication to assist in identifying fraudulent requests.

Automate and accelerate the secure management of identity access.

Optimizing identity verification processes and workflows to unburden customers while meeting regulatory compliance.

Create a “bad actor” watchlist. and uncover fraudsters with leading Fintech identity verification.

Enhance Your IDV Strategy

- Choose the right IDV technology for your organization

- Deploy it effectively to protect user data

- Optimize its use to prevent fraud & ensure security

Product Recommendations

At nearly any point in the customer journey, from the onboarding process to transactions and ongoing authentication, there are new risks to data privacy and identity. Our portfolio of products offers a complete financial fraud solution to meet any business’s KYC and IAM requirements.

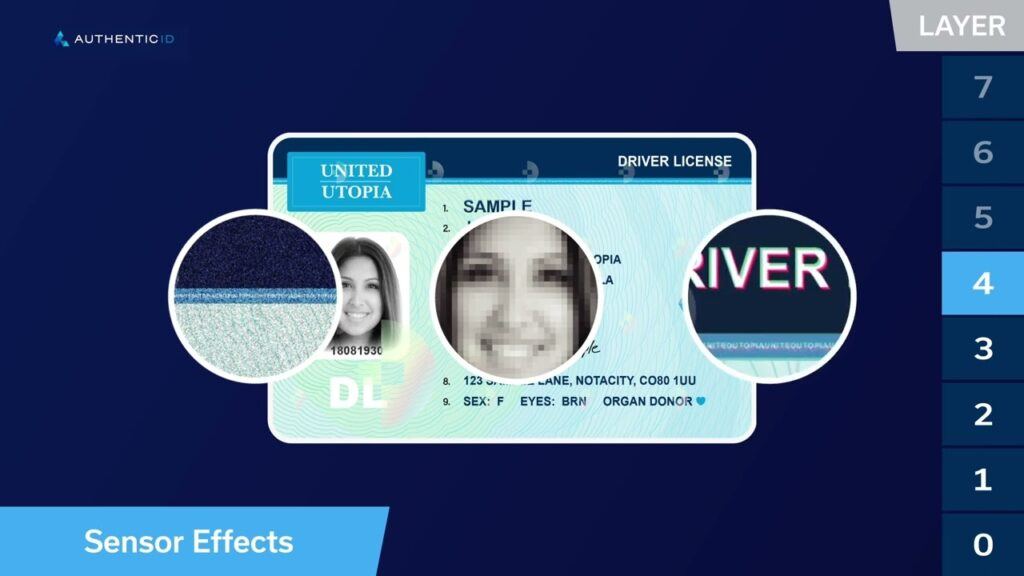

AuthenticID’s facial biometric technology provides a fast, simple way to authenticate an individual by matching a person’s selfie to the photo on a government-issued ID, profile picture, or any other image of a person’s face with complete accuracy.

FAQs for Financial Services

READ MORE FAQsIdentity verification in financial services involves the platforms and processes that help institutions build trust, enhance security, and meet regulatory requirements. A strong solution should take a multifaceted approach, using tools like ID document verification, biometric authentication, watchlist screening, step-up authentication, and multi-factor authentication.

Verification should be applied throughout the customer journey and across all channels—including in-branch, call centers, and digital experiences.

When properly implemented, identity verification helps financial institutions prevent fraud, ensure compliance, avoid costly fines, and deliver a seamless, secure user experience.

AuthenticID’s identity verification solution can be used by multiple types and sizes of financial services organizations, including traditional banks, credit unions, commercial banks, and investment banks.

In addition, identity verification is crucial for lenders, asset managers, fintech companies, private equity firms, and broker-dealers. Each of these financial institutions must comply with regulations like AML and KYC, making identity verification a critical part of compliance.

AuthenticID identity verification offers trusted KYC (Know Your Customer) and KYB (Know Your Business) regulations, as well as anti-money laundering (AML) regulations. AuthenticID’s solution is both robust and scalable, allowing financial services institutions to quickly authenticate users with continuous monitoring and reauthentication in seconds.

With AuthenticID, financial services organizations can lower their risk of regulatory fines while stopping identity fraud.

Let’s Connect

If you have product questions, we have answers. Our team is here to help.

Schedule My Demo

Find out why AuthenticID is the undisputed leader in identity processing and see how we can help your organization mitigate risk, convert customers, and reduce operational costs with our frictionless ID proofing solutions for ultimate security.