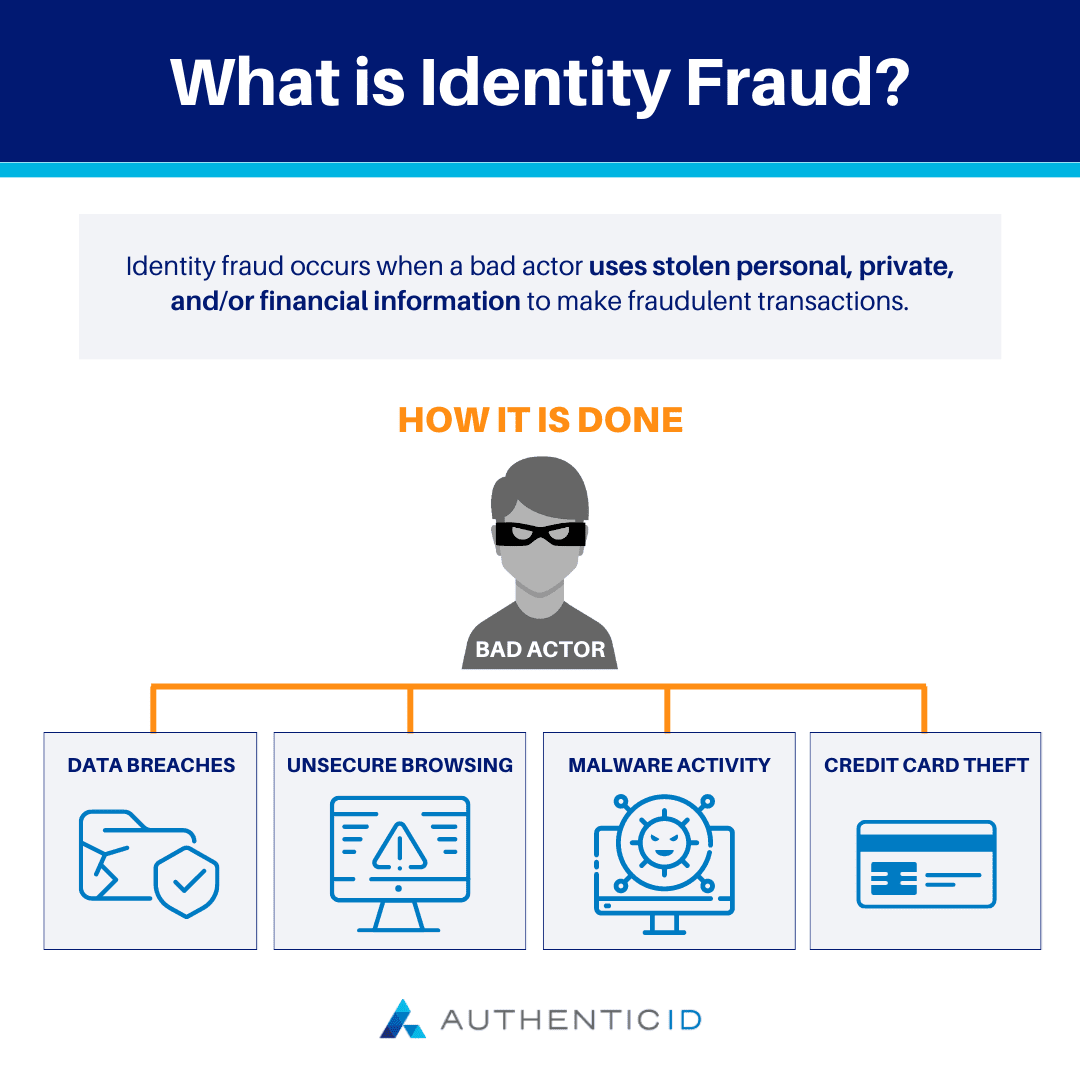

Identity fraud occurs when a bad actor uses stolen personal, private, and/or financial information to make fraudulent transactions. How bad actors can obtain a user’s identity occurs in a variety of ways, including both physical and digital means. A bad actor can utilize a fake ID, false credit card or bank accounts, fraudulent transactions, and a fake criminal record. Identity fraud continues to grow, with a tremendous impact on users and businesses.

Commonly utilized for financial gain and organized crime, identity fraud has been around for decades, with criminals only making their tactics more sophisticated as the world becomes increasingly digitized.

Though there have been many regulations and laws put in place, layers of security added online, and specific software and applications developed to help protect consumers from these crimes, the FBI reports that there are still over 50,000 instances of identity theft each year.

The best way to protect yourself against identity fraud and related crimes is to know what to look out for in addition to practicing safe Internet browsing to avoid becoming one of their victims.

What Is Identity Fraud?

Identity fraud, often referred to as identity theft, occurs when a criminal uses another person’s personal information without their consent for the purpose of committing a crime or deceiving the victim or others.

As noted above, identity fraud mainly accompanies financial crimes, like accessing the person’s bank account, credit card, and more. However, using falsified identity documents to gain unauthorized access while committing other crimes is another common use case of identity fraud.

As criminals become more advanced with their methods and tactics for utilizing identity fraud, it is becoming increasingly difficult for victims to unravel the web of crime that the criminal has entered into using the victim’s identity and personal information. As such, the victims may appear to be doing the crimes, or at least involved in the planning aspect, and face consequences themselves until the truth is revealed.

Common Uses of Identity Fraud

The United States Federal Trade Commission has laid out six major categories for identity fraud crimes, including:

• Bank Fraud

The criminal uses the victim’s personally identifiable information to gain access to their bank accounts and take over control of the accounts; they may attempt to switch the name on the account, transfer the money into another account under someone else’s name, open up a new account, and more

• Credit Card Fraud

A criminal uses someone’s credit card number or stolen credit card to make unauthorized purchases

• Government Benefits Fraud

The criminal uses a victim’s personal information to obtain government benefits

• Employment / Tax-related Fraud

The perpetrator takes the victim’s Social Security number and other personally identifiable information to get a job or file a tax return

• Loan Fraud / Lease Fraud

This occurs when a criminal uses someone’s name and personal data to get a loan or lease; typically occurs when the perpetrator does not have the credit to do so on their own, or is trying to evade the law by keeping their name out of official records

• Phone Fraud / Utility Fraud / Telecom Fraud

The perpetrator uses someone’s personal information to open up a phone or utility account for their own use; similar reasoning as above with loan and lease fraud

How Does Identity Fraud Work?

Given the vast array of reasons why criminals commit identity fraud, there are many ways that you can become the victim of their crimes.

The criminals simply need to get enough of your personally identifiable information (PII) that’s required to access your bank account, file an employment application using your name, apply for government benefits, and more. Thus, their tactics for gaining this information can depend on the nature of the crimes and fraud they’re attempting to commit and your own personal behavior and activities.

For instance, if you need to give your credit card number and information over the phone, make sure you are in a private place. If someone is listening in nearby, it would be easy for them to grab your credit card number, the name on your card, the security code, and the expiration date as you spell them out to the person on the other end of the line. Then, they can use this information to make unauthorized purchases online or over the phone until they are caught.

In addition, spam emails with fake or misleading links often lead people to become victims of identity fraud–or phishing. By clicking on the link in the email, or responding with personal information, you can give the criminal access to your data or even what’s stored on your computer. So, this is something you need to always be on watch for, and review the top phishing tactics to help yourself avoid this scenario.

Another common example that people need to watch out for is when they receive “pre-approved” credit cards in the mail. If you simply discard the materials without shredding or destroying them, a criminal may pilfer your trash and try to activate the card without your knowledge.

Risks of Identity Fraud

The open-ended nature of identity fraud and the cunningness of criminals makes it difficult to spell out all the possible risks of becoming one of their victims. However, here are some of the biggest consequences you may face if it happens to you.

1) Wiped out Bank Accounts

One of the biggest risks of becoming a victim of identity fraud is that the criminal will gain access to your bank account or other financial assets and wipe them clean. This can happen either by draining the account through spending or transferring the funds to a different account controlled by the criminal or a related party.

2) Credit History Destroyed

Another common risk of this crime is that the perpetrator is able to take out loans or open up credit card accounts using your information–with no intention to pay back their debts. As a result, your credit score and history will suffer, which could be very limiting for you and your own financial needs.

3) Criminal Arrest

While rare, it is possible for a victim of identity fraud to be arrested for activities that were done by the criminal using their identity. This is a risk since identity fraud almost always accompanies other crimes. Depending on how sophisticated the criminal was, it can be difficult to get to the bottom of their crimes and reveal their true identity. In many cases, it’s possible that the criminal has gone through a string of stolen identities, shielding their own identity under layers and years of crime.