Although Know Your Business compliance is relatively new in the United States (since 2016), it plays an important role in upholding the integrity of the economy and keeping crime organizations from getting access to valuable financing. Thus, the implications of Know Your Business regulations are extremely widespread, even concerning public safety.

Knowing who your corporate clients are is an important, and often required, aspect of doing business today. Having a good idea of who the owners and stakeholders are and how they make money can help support anti-money laundering efforts. In doing so, you can ensure that you’re only doing business with legitimate entities that are operating legally.

Essentially, many firms today need to ensure that their customers are who they say they are before they can begin their engagement.

What Is Know Your Business?

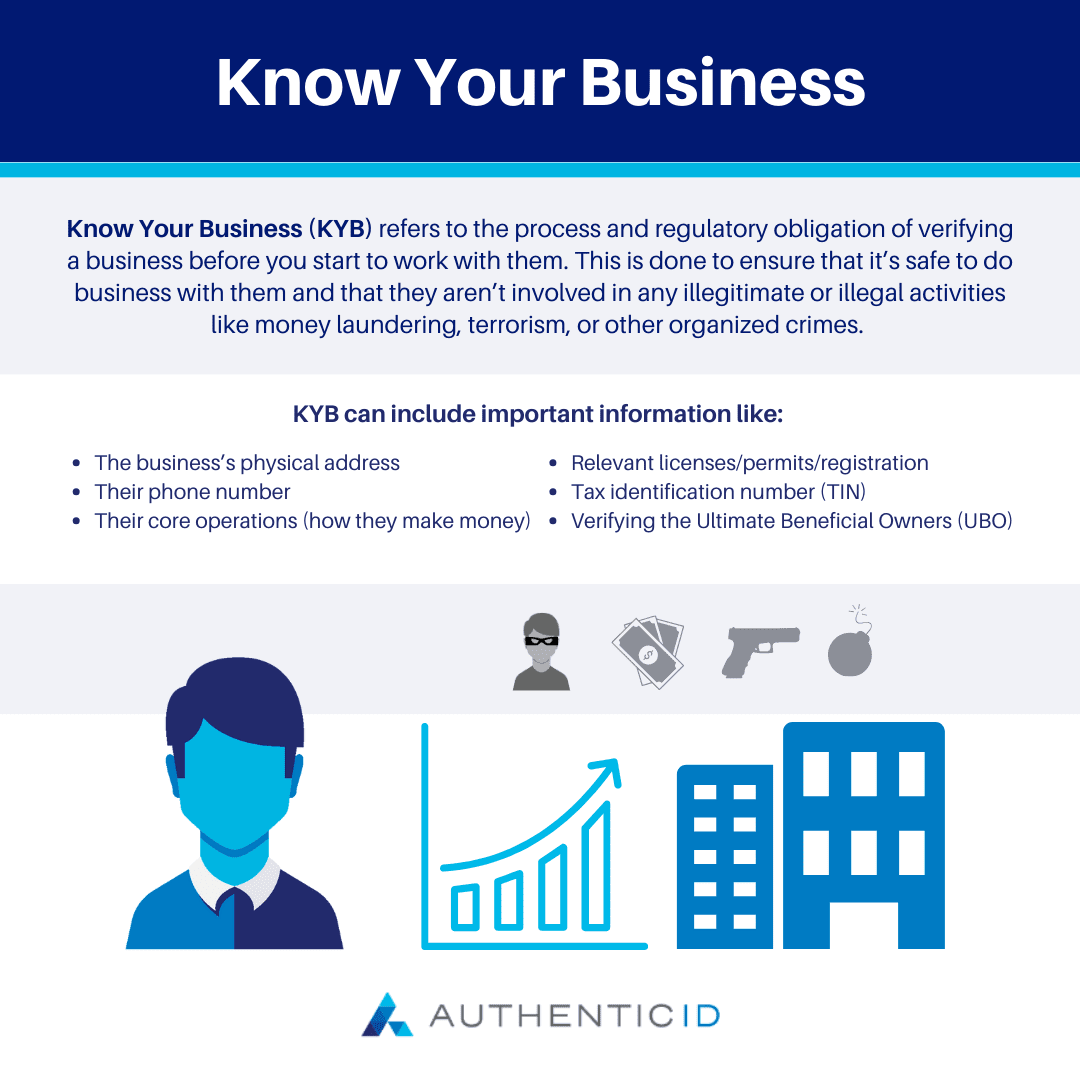

Know Your Business (KYB) refers to the process and regulatory obligation of verifying a business before you start to work with them. This is done to ensure that it’s safe to do business with them and that they aren’t involved in any illegitimate or illegal activities like money laundering, terrorism, or other organized crimes.

KYB can include important information like:

- The business’s physical address

- Their phone number

- Their core operations (how they make money)

- Relevant licenses/permits/registration

- Tax identification number (TIN)

- Verifying the Ultimate Beneficial Owners (UBO) of the company

In other words, you need to know the nature of your client’s business, how they make money, and who is benefiting financially from the business’s operations. In certain industries or jurisdictions, KYB may be required by law at the onset of a business relationship, and also on an ongoing basis over the duration of the engagement.

Specifically in the financial services industry, FINRA, a regulatory body, states the following:

“Every member shall use reasonable diligence, in regard to the opening and maintenance of every account, to know (and retain) the essential facts concerning every customer and concerning the authority of each person acting on behalf of such customer.”

Of course, it would be impossible to detect every potential fraud-related incident by your clients. However, in many industries, there is a certain level of due diligence you must perform to help detect and prevent these acts from occurring.

Who Needs to Implement KYB?

Within the United States, there are a few specific types of companies that need to collect KYB information on their customers. Such compliance is regulated by the Customer Due Diligence Final Rule of the Financial Crimes Enforcement Network (FINCEN).

While the regulatory landscape surrounding these laws will continue to evolve, these are the current companies that need to implement KYB checks:

- Banks

- Fintech companies

- Lenders

- Mutual funds

- Securities brokers/dealers

- Payment providers

- Commodities brokers

- Futures commission merchants

- Mutual funds

- Other financial institutions

How Do You Collect Know Your Business Information?

Businesses must collect and verify the above information when they onboard a new business client. So, this can be done either through an intake form, an online portal, specialized software, manual checks, etc. Plus, they must update this information on an ongoing basis to stay compliant.

Collecting and maintaining this KYB information can be costly to businesses, however, it is just good business to be aware of who your customers are and how they operate. Plus, it’s required by law for the above companies.

There are now emerging technology and software tools to help businesses implement KYB, without having to do so manually. Such tools have made KYB much more reasonable to implement and not so intrusive or costly to operations.

Benefits of Know Your Business

The benefits of Know Your Business are multi-faceted across a number of stakeholders. Though it does add a greater regulatory burden to firms to implement, the widespread advantages make it a worthwhile investment. Let’s take a look at some of the top benefits that KYB provides.

1. Better Risk Management

Know Your Business regulations help businesses better assess the potential risks associated with their clients and business partners. KYB gives them a better idea of who they are dealing with, allowing them to identify and mitigate potential risks like fraud, money laundering, and reputational damage.

As such, businesses that have implemented KYB can make more accurate credit decisions, do better negotiating, and foster more favorable business relationships.

2. Regulatory Compliance

Today, there are many regulatory bodies and jurisdictions that make it obligatory for companies to meet AML and counter-terrorism financing (CTF) regulations. Thus, implementing KYB checks for corporate clients helps them stay compliant with these regulations and avoid possible penalties or fines if found non-compliant.

3. Reduced Fraud & Financial Loss

One of the biggest advantages of KYB is that it can help financial institutions better detect fraudulent activities and prevent them from engaging in illegitimate businesses in the first place. Companies can avoid engaging in business with potentially risky entities, even if by accident. Over time, this helps financial institutions reduce their likelihood of financial loss down and potentially harming their reputation from bad business dealings.

4. Enhanced Business Relationships

Performing KYB helps you have greater trust in your customers and can enhance your business relationships. KYB should help you see the background and legitimacy of your client’s operations, building up your confidence in their business and promoting long-lasting partnerships.

Main Use Cases of KYB

To further understand how KYB works in practice, here are some of the main applications of KYB across the financial industry.

- AML & CTF Compliance: KYB helps financial institutions meet relevant regulatory requirements; they can ensure they are not unknowingly facilitating money laundering or terrorist financing activities by verifying through KYB checks

- Payment Processing: Merchants and payment processors can use KYB to evaluate the risk associated with potential clients applying for payment processing services; they can ensure clients are operating legitimate businesses and have low risks of fraud or chargebacks

- Investing and Lending: Financial institutions can assess the creditworthiness and risk profile of potential borrowers using KYB checks, which can help evaluate the financial health and stability of the business based on the nature of their operations