In the modern digital landscape, where cyber threats loom large and data breaches are a constant concern, the importance of robust identity verification and authentication cannot be overstated, particularly for insurance companies. As guardians of sensitive personal and financial information, insurance providers have a duty to protect their customers from fraud, identity theft, and other malicious activities. Let’s delve into why identity verification is crucial for insurance companies and explore the various use cases where it plays a pivotal role.

Top 5 Reasons Identity Verification Is Crucial for Insurers

#1 Identity Verification Safeguards Against Fraud

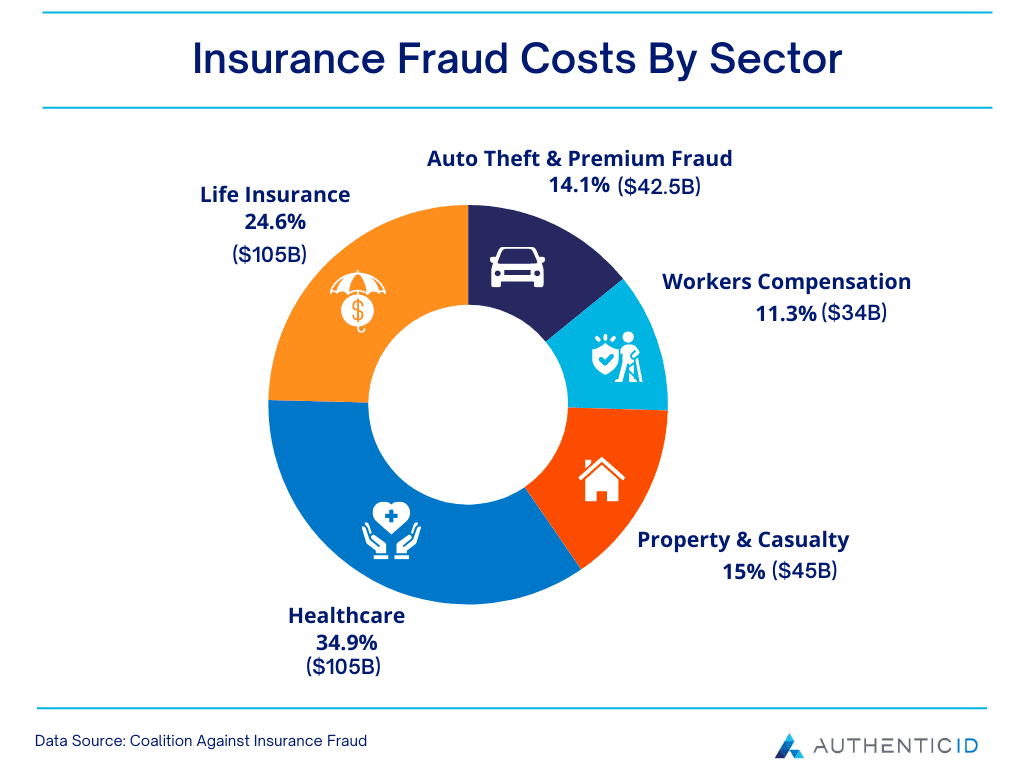

According to the FBI, the total cost of insurance fraud is estimated to be more than $40 billion per year. This translates to an additional financial burden of $400 to $700 per year for the average U.S. family, reflected in elevated premiums. Whether it’s through falsifying claims, identity theft, or misrepresentation of information, fraudsters continuously seek to exploit vulnerabilities within insurance systems. Robust identity verification measures act as a frontline defense against such fraudulent activities. By confirming the identity of policyholders and beneficiaries through stringent identity proofing processes and step-up authentication, insurance companies can mitigate the risk of fraudulent claims and protect their financial assets.

#2 Building Customer Trust

In a digital era where trust is paramount, establishing and maintaining credibility with customers is imperative for insurance companies. Identity verification not only safeguards against potential fraud but also instills confidence and trust among policyholders. By demonstrating a commitment to security and privacy through robust identity verification and user authentication processes, insurance companies can reassure customers that their personal information is being protected, responsibly. This fosters a positive relationship built on trust, which is essential for customer retention and brand reputation.

#3 Identity Verification Streamlines the Underwriting Processes

Efficient underwriting processes are essential for insurance companies to accurately assess risk and determine premiums. Identity verification plays a crucial role in streamlining these processes by ensuring the accuracy and validity of the information provided by applicants. Through identity verification, insurers can authenticate the identities of applicants, verify their credentials, access relevant identity data, and collect risk signals to make informed underwriting decisions swiftly. This not only improves operational efficiency but also helps mitigate the risk of insuring fraudulent or high-risk individuals.

#4 Identity Verification Helps You Stay Compliant with Regulatory Standards

The regulatory landscape governing the insurance industry is constantly evolving, with stringent requirements aimed at protecting consumer interests and preventing financial crimes. Identity verification is a key component of regulatory compliance for insurance companies, ensuring adherence to Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulatory standards. By implementing robust identity verification processes, insurers can demonstrate compliance with these regulations, mitigate legal and reputational risks, and avoid hefty fines and penalties.

#5 Identity Verification Facilitates Digital Transformation for User Convenience

Digital transformation of the insurance industry has ushered in a new era of convenience and accessibility for customers. However, with the shift towards online platforms and digital interactions comes an increased risk of cyber threats and identity fraud. Identity verification solutions tailored for the digital landscape enable insurance companies to authenticate users remotely, more quickly and more securely.

Types of Identity Verification Methods for Insurance Companies

- ID Verification – When verifying a government-issued ID during a new account opening, it’s never a good idea to rely on the human eye. Simply put, machines do it better. AI-based ID Verification solutions can run over 500 forensic checks on both the back and front of an ID in just seconds to ensure it’s real. Plus, during the verification process data from the ID can be extracted and used to quickly fill in online forms for more seamless account enrollment.

- Biometric Authentication – With Biometric Authentication, insurance companies can ensure the person who is in possession of the ID is the person on the ID. Even seasoned security and law enforcement professionals have difficulty matching a face to an ID, so this too is a better task for an AI-based Identity Verification Solution. Further, when verifying over a digital channel, biometric authentication safeguards against deep fake videos or digital photos by swiftly authenticating individuals through a selfie capture, ensuring the person’s real identity.

To Sum it Up, Identity Verification Should be a No-Brainer.

Using Identity Verification technology isn’t just a must do for insurance companies, it’s like wearing a seatbelt – it’s a no-brainer! From safeguarding against fraud and enhancing customer trust to streamlining underwriting processes and ensuring regulatory compliance, the importance of robust identity verification cannot be overstated. By investing in advanced insurance identity verification solutions and adopting a proactive approach to security, insurance companies can protect their customers, safeguard their assets, and thrive in this ultrafast, ever-evolving landscape of risks and opportunities.