Identity verification means that a business can confirm the identity of its customers. Identity verification is a process that ensures a person is who they claim to be. This process analyzes data sets, often using AI Machine learning technology to verify the authenticity of an identification document such as an ID and/or a biometric identifier such as face or fingerprint.

Identity verification means that a business can confirm the identity of its customers. This is important because it helps companies ensure they are doing business with real people and not impersonators, fraudsters, or others who may try to take advantage of them. The risk of allowing a bad actor or fraudster access to a company’s network, applications, or services is huge: a Javelin study reported that identity fraud losses skyrocketed in 2021 to over $24 billion, a 79 percent increase since 2020. Identity fraud scams also led to a $28 billion loss, with a combined number of $52 billion lost due to fraud.

In addition to fighting fraud, identity verification also helps businesses stay compliant with regulations that require them to verify the identities of their customers. Finally, identity verification reduces the risk of fraud for organizations by allowing them to confirm that transactions are being made by legitimate individuals who can be held responsible for those transactions if something goes wrong.

In this article, we’ll discuss the most common industry applications for identity verification, what to know regarding compliance and regulation, and the technology that powers the most cutting-edge identity verification.

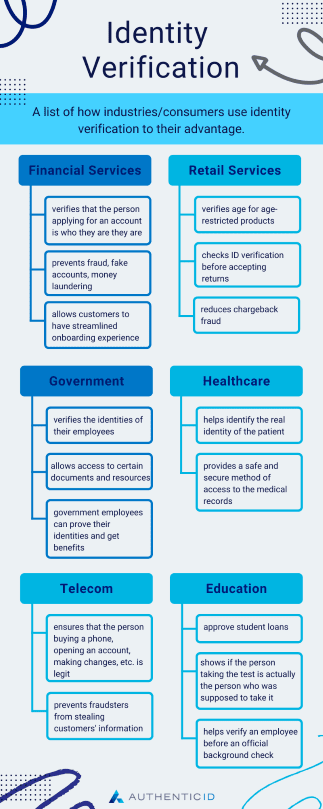

The most common industry applications and use cases for identity verification

Identity verification is used in a wide range of industries and applications, but the most common use cases include:

- Financial Services

- Retail

- Government

- Healthcare

- Telecom

- Education

- Social media

- GIG/Sharing Economy

- E-commerce

To learn more about these use cases, we’ll dive deeper into each industry and outline potential use cases.

Financial Services

Identity verification helps financial institutions verify that the person applying for an account is who they say they are. In the financial industry, it’s also necessary for KYC and AML compliance. It’s all about making sure that no one can impersonate you—and it can help anyone who wants to apply for an account with your bank, brokerage, credit union, etc.

For example, when customers open a bank account online at Chase Bank or Wells Fargo and must provide a Social Security number, the bank must verify that this is your real SSN—not one stolen from someone else. Often though, this data is not enough, and could have been available through data leaks. Secondary methods of authentication will also help prevent fraud, fake accounts, money laundering, and more.

This same process happens with other types of financial transactions. For instance, users attempting a purchase online with PayPal or Venmo must give away their credit card number (including Apple Pay). As a result, the payment processor may ask for some basic information about yourself first before approving the payment request. This prevents people from buying things with stolen credit cards.

Retail

Many retailers need to verify the identity of their customers. This is especially true for those who sell age-restricted products, such as alcohol or tobacco. Most US states allow people over 21 to buy and consume alcohol. Still, many stores require that you be of legal age to purchase specific items.

In addition, some companies may require ID verification before they accept returns on products they’ve purchased from you. For example, suppose you bought something online and tried it on at home (within 30 days) but didn’t like it. In that case, the company might ask you to get a refund by sending back the item with proof of purchase (in this case, your ID).

Most importantly, companies want to reduce chargeback fraud. This can be done by implementing strong identity proofing by capturing a government issued ID and selfie before checkout. This is especially important for high cost goods and transactions.

Government

As an employer, you may be required by law to verify the identity of your employees. If you don’t, you could face fines or other penalties. As an employee, government identity verification can help you get your unemployment benefits or taxes.

In addition, individuals must be verified if they are seeking a government benefit. You can use a government ID such as a passport, driver’s license, or state identification card to prove your identity when applying for these things:

- Unemployment benefits

- Social Security Benefits

- Medicare

Healthcare

Identity verification helps with healthcare because it provides a safe and secure method of access to health benefits and medical records.

When you need to access your medical records, identity verification software for healthcare makes sure that you are who you say you are, so that only the right people can see them. At the same time, this also allows for strong underwriting with time stamped images of a verified government ID and selfie for an access request.

Telecom

The telecommunications industry has a tremendous need for identity verification, as the merging of retail, digital, and call center workflows offers several opportunities for fraud. Providing telecommunications services is now a complex web of products and services that touches an astonishing number of businesses and daily activities of the average person. Retail, digital, and call center workflows all require identity verification. For instance, mobile phone purchases and cell phone service are growing fraud targets, with SIM Swap, Account Takeovers, and Friendly Fraud, among a variety of types of fraud, increasing in number and impact. To ensure the person purchasing a phone, opening an account, or making changes to an account is legit, a customer will need to verify their information via an ID document with other step-up processes, including facial biometric authentication.

For instance, say an individual contacts a telecom customer service agent saying they need to swap their account to a new SIM card. This bad actor could be armed with stolen data to get access to a legitimate customer account, and could persuade a telecom employee to swap the account to a SIM the fraudster controls, allowing the fraudster access to the SMS messages and PINs necessary to authenticate customer identity for payment and account transactions. This SIM Swap fraud could be prevented by strong identity verification.

Education

Organizations that use IDV include: University admissions offices, student loan providers, financial aid offices and officers, student ID cards (access to school facilities), and employment verification for employees hired before conducting an official background check.

In addition, with more education programs being offered online, identity proofing via a government ID and selfie facematch can allow confirmation and strong underwriting if the person attending the class, taking the test, or getting certified is indeed the correct individual.

Other Industries Identity Verification is Vital

Social media platforms like Facebook and Twitter have asked users to confirm who they say they are for a long time. This process is known as social media identity verification, but it’s not the same as digital identity verification. Social media platforms use this information to ensure that users aren’t bots or false accounts, but don’t use it to verify your real-life identity beyond knowing your name and birthday. Age verification can protect young users on social media, which can ensure children are kept safe from not only adult content, but also potential traffickers and predators that may be lurking on these platforms.

Blockchain technology can be used for digital asset ownership verification, which is the most crucial aspect of digital identity regarding ownership rights in an online economy where you can sell anything from music files to concert tickets via blockchain transactions.

Gig Economy and Rideshare companies like Uber or Instacart require workers to undergo background checks before starting employment with them. Thus, they have basic information about who their drivers/gig workers are. Not only does this process cover qualifications, but it helps keep both drivers and riders safe in rideshare programs. And in delivery services like Instacart, age verification is key to ensure products like alcohol are delivered to adult consumers.

Regulatory compliance, data protection acts, and identity verification

Managing regulatory compliance to meet the wide number of requirements set by the government and non-government organizations is a big task for most businesses. If companies aren’t in compliance, they’ll face hefty fines in addition to leaving themselves open to fraud. That’s why utilizing ID verification is a key piece to managing the complexity of regulatory compliance.

- KYC – Know Your Customer. This regulation requires companies to identify their customers and perform due diligence on them as part of the customer onboarding process. This helps prevent financial crimes such as money laundering and terrorist financing. It’s also used across many industries—even dating sites use KYC to verify their members’ identities! Suppose a company doesn’t have proper KYC procedures. It could face fines or even be shut down entirely by regulators like the SEC (Securities and Exchange Commission). Complying with KYC regulations also reduces onboarding friction by making it easier for new users to onboard and gain access to your services.

- AML – Anti-Money Laundering Act of 2020. The AMLA 2020 also establishes a broader set of authorities to keep up with the challenge of combating financial crime in an increasingly globalized economy. Under the new law, law enforcement agencies have the power to subpoena international financial institutions that hold correspondent accounts in the U.S

- CCPA (California Consumers Privacy Act) – The CCPA requires businesses to provide consumers with clear disclosures about what information is collected about them, how the information is used and shared, and whether the consumer can opt out of certain types of collection or sale. It also requires companies to provide an opt-in option for sharing personal information with third parties and requires consumers be given access to their own data upon request.

- KYB (Know Your Business) – Growing businesses especially may have concerns regarding expanding their business partners to ensure these partners are not scammers or fraudsters. KYB (Know Your Business) is the answer. KYB is a way for companies to verify their identity and ensure the legitimacy of the businesses they’re working with, while still allowing those businesses to prove their own identity through KYB’s process. The result is an efficient verification system that protects both parties from risk without alienating anyone—and without requiring a lot of time or money spent on third-party verification services.

- GDPR (General Data Protection Regulation) – One way to comply with the GDPR, the legal framework that sets guidelines for the collection and protection of personal data of individuals who live in the European Union (EU), is to make sure that your web-based solutions are GDPR compliant. And that’s where identity verification helps. Identity verification helps ensure that only authorized personnel have access to personal information, and it helps prevent fraudsters from accessing sensitive data. Furthermore, it helps you meet GDPR requirements by ensuring that all parties involved in a transaction are properly identified and authenticated.

- COPPA (Children’s Online Privacy Protection Act) – The Children’s Online Privacy Protection Act, or COPPA, protects the online privacy of children under the age of 13. Identity verification helps with compliance because it allows your site administrators or moderators to quickly gather parental consent whenever necessary. They can do this, in the same way, they would gather any other kind of user information such as name, email address or phone number — but only if they already have an account on their system first.

- Red Flag Rules – The Red Flag Rules are regulations put in place by the Consumer Financial Protection Bureau (CFPB) to prevent identity theft and fraud. Identity verification solutions can help you meet these requirements by monitoring your customers’ behaviors and identifying suspicious activity that could indicate an identity thief is trying to take over their accounts. Identity verification solutions also help you comply with other regulations like those set forth in the Fair Credit Reporting Act (FCRA), which require you to protect customer information from being used for unauthorized purposes.

Technology in identity verification

Digital transformation is a general term for the shift from traditional forms of ID to digitized versions. We are moving from an era where you carry physical documents that establish your identity, such as your passport or driver’s license, to an age where these documents can be stored in a digital form. This includes digital wallets/identity wallets, ePassports, and digital licenses.

As we move towards this future, there is still one major challenge – how do we verify identities with accuracy?

Machine Learning & AI: AI and Machine Learning models are especially useful in evaluating identity documents. When using robust data sets, and with ongoing use, machine learning, AI learns in real-time, meaning these algorithms can detect fraud in even the most sophisticated documents, and have better rates of confirming authentic documents as well.

Biometrics: Biometric technology utilizes physical characteristics, including but not limited to fingerprint, facial scan, retina scan, etc. to identify someone. Biometric technology is increasingly used in security processes to authenticate and re-authenticate users to ensure a user is who they say they are, and has increasingly been trusted by consumers as a way to validate their identity. Facial biometrics, whether used to open your mobile phone or access an account, have also grown in popularity, with new technology to fight spoof attempts also making strong options against fraud.

In conclusion

Identity verification protects consumers, the financial system and the economy from fraud and crime. Businesses that rely on identity data for risk management and financial decision-making depend on accurate information about their customers. As much as we’d like to think that everyone uses their real identities online, the truth is that more than a few individuals who fall into the category of people who mask their real identities. That’s why this process is critical for business success and consumer confidence.

Identity verification is often part of a company’s comprehensive fraud-fighting measures–confirming the identities of both employees and customers not only protects against identity fraud, but its ability to streamline onboarding and other workflows can also increase conversions, and provides enhanced underwriting and reduced operational costs while increasing scalability. That’s why the right solution often includes a variety of measures, including biometric authentication, document verification, and watchlist services.

If you’re looking for a cutting-edge solution for your company, contact the expert team at AuthenticID to work through the right solution for your workflows.