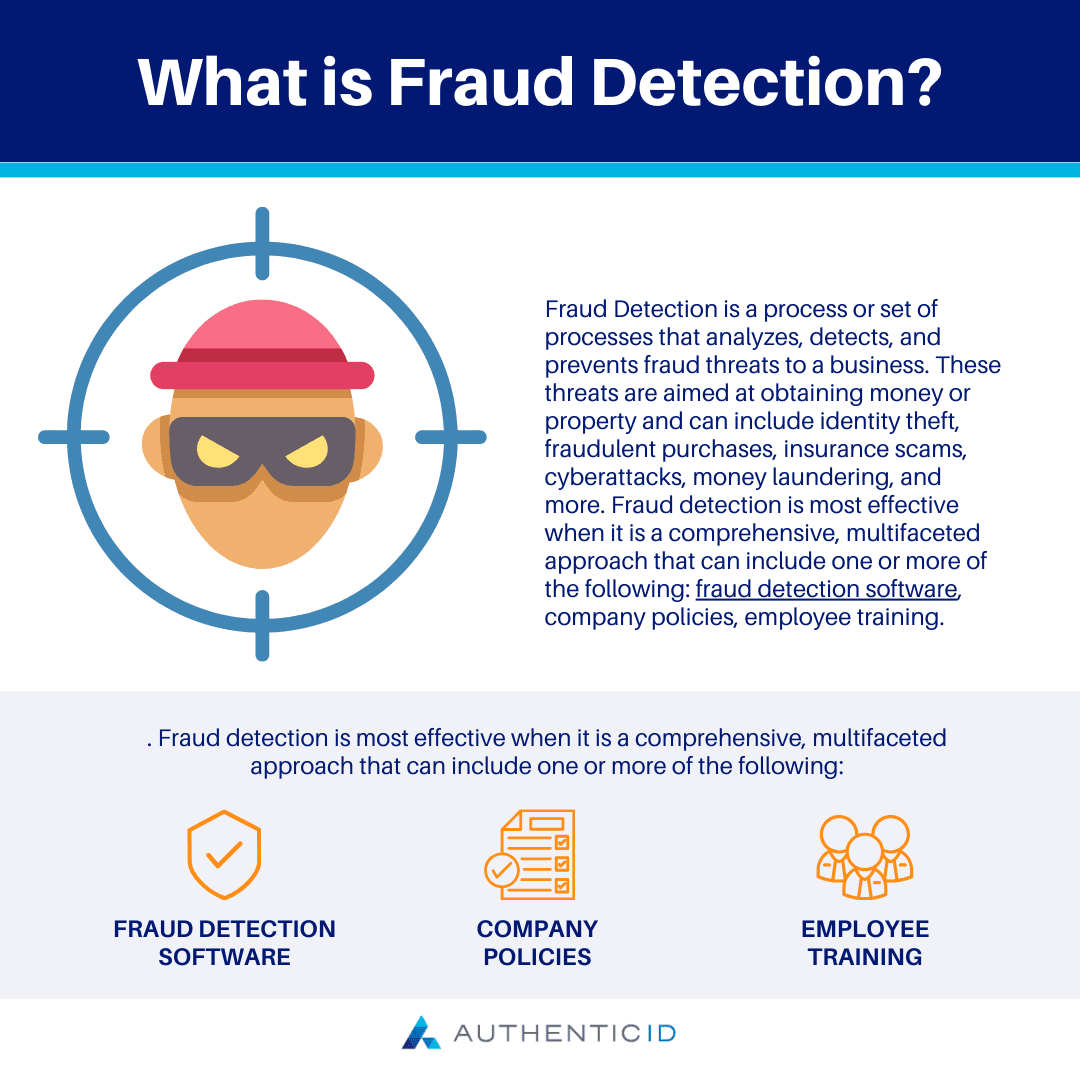

Fraud Detection is a process or set of processes that analyzes, detects, and prevents fraud threats to a business. These threats are aimed at obtaining money or property and can include identity theft, fraudulent purchases, insurance scams, cyberattacks, money laundering, and more. Fraud detection is most effective when it is a comprehensive, multifaceted approach that can include one or more of the following: fraud detection software, company policies, employee training.

As technology advances, fraudsters continue to evolve their tactics in lockstep to make them more sophisticated and evade Fraud Detection programs.

Thus, Fraud Detection processes should not be static. They must continually adapt and change to curb instances of fraud and mitigate the risk of financial loss, identity fraud, and other crimes.

With proactive Fraud Detection processes in place, organizations can better defend themselves, avoid being exploited by fraudsters, and bolster their data security and privacy.

What Is Fraud Detection?

Fraud Detection is a process or set of processes that analyzes, detects, and prevents fraud threats to a business. These threats are aimed at obtaining money or property and can include identity theft, fraudulent purchases, insurance scams, cyberattacks, money laundering, and more.

Fraud Detection is most effective when it is a comprehensive, multifaceted approach that can include one or more of the following: fraud detection software, anti-money laundering (AML) policies, company protocols, and employee training.

Why Should Organizations Care About Fraud Detection?

Fraud can be costly, devastating, and harm a business’s reputation if they become a victim of fraudsters’ criminal activity. In the global ecommerce market alone, the total estimated cost of fraud in 2023 is set to top $48 billion for the whole year.

Thus, potential financial loss is one of the biggest reasons why organizations need to invest in their Fraud Detection systems, which can help them identify and prevent fraudulent activities before they can occur. In turn, this can make the organization more efficient and find cost savings elsewhere in their operations as they spend less time and resources investigating possible fraud.

In addition, instances of fraud can severely harm an organization’s reputation with its employees, clients, customers, and other stakeholders. These individuals may feel that their personal information is not safe with the organization and that they have not taken the proper measures to safeguard their data.

Lastly, some industries and jurisdictions have imposed certain regulations around Fraud Detection and prevention, requiring organizations to implement robust detection systems to maintain compliance with such standards.

Common Types of Fraud

Fraud can appear in many different ways, and be done for a variety of reasons and motives. However, it’s important to understand the main types of fraud that an organization can face to understand how to best detect and prevent it.

1. Billing Fraud: When a supplier attempts to defraud a business by inflating legitimate invoices or sending duplicate or fake invoices for services or goods that were not rendered, hoping the business will make the payment before noticing the error.

2. Chargeback Fraud: Occurs when a customer disputes a charge with their credit card company for an item they actually purchased, receiving both a refund and keeping the ordered item.

3. Embezzlement: Employees of a business may misappropriate the company’s funds for their own benefit, either with forgery of payroll records, using a purchase card for unauthorized purchase, or other activities.

4. Account Takeover Fraud: An unauthorized user may gain access to an employee’s or customer’s account with stolen login credentials to make unauthorized purchases, identity theft, attempted phishing attacks, and other malicious or criminal activities.

5. Expense Fraud: If an employee makes a false reimbursement claim for fake or exaggerated expenses.

Possible Challenges with Fraud Detection

As we have discussed throughout, there are some challenges associated with Fraud Detection in today’s digital world.

Primarily, this includes the fact that fraudsters’ are able to enjoy the advantages of technology evolutions just as all other legitimate tech users. This creates some difficulties as organizations aim to curb fraudsters’ attempts and tactics, which are constantly evolving. Below, we will cover some of the main challenges with Fraud Detection that can keep these programs from being effective.

1. Rising Costs

Investing in a robust Fraud Detection system or making substantial upgrades to an existing program can be resource-intensive. Especially when it comes to adopting new technologies like machine learning programs or artificial intelligence algorithms, the cost to implement these tactics for Fraud Detection can become infeasible for organizations, and thus deter them from improving their systems.

2. Transaction Speed

The speed with which transactions today are completed makes it harder for organizations to prevent fraudulent purchases before they can be processed. While this speed and convenience is a bonus for legitimate transactions, this can pose challenges in the case of an unauthorized purchase.

3. Online Shopping

With much of business today occurring online, customers don’t need to visit a store in order to make a purchase. Thus, it’s easy for fraudsters and criminals to use stolen credentials or payment methods to make a purchase online while going undetected.

How Can Organizations Improve Fraud Detection?

Though Fraud Detection is growing more challenging as the years progress and technology advances, there are some key ways that organizations can bolster their approach to help detect and prevent these incidents.

The following are some suggestions for how organizations can improve their existing Fraud Detection systems. By creating a comprehensive system that employs multiple methods for detection and prevention, organizations can be more proactive against fraud.

- Employee Training: Organizations should conduct regular training sessions to educate employees on common fraud schemes, phishing tactics, and the importance of security protocols

- Internal Controls: Implement separation of duties to ensure that no single individual has complete control over a critical process, reducing the risk of internal fraud; this also calls for restricting access permissions based on job roles and responsibilities to prevent the misuse of privileges

- Machine Learning/AI: If resources allow, utilize machine learning algorithms to analyze patterns with behavioral analytics and identify anomalies that may indicate fraudulent activities; implement predictive modeling to assess risk and anticipate potential fraudulent transactions or activities based on historical data

- Real-Time Monitoring: Use real-time monitoring tools to analyze transactions for unusual patterns or inconsistencies that may indicate fraudulent activities are underway